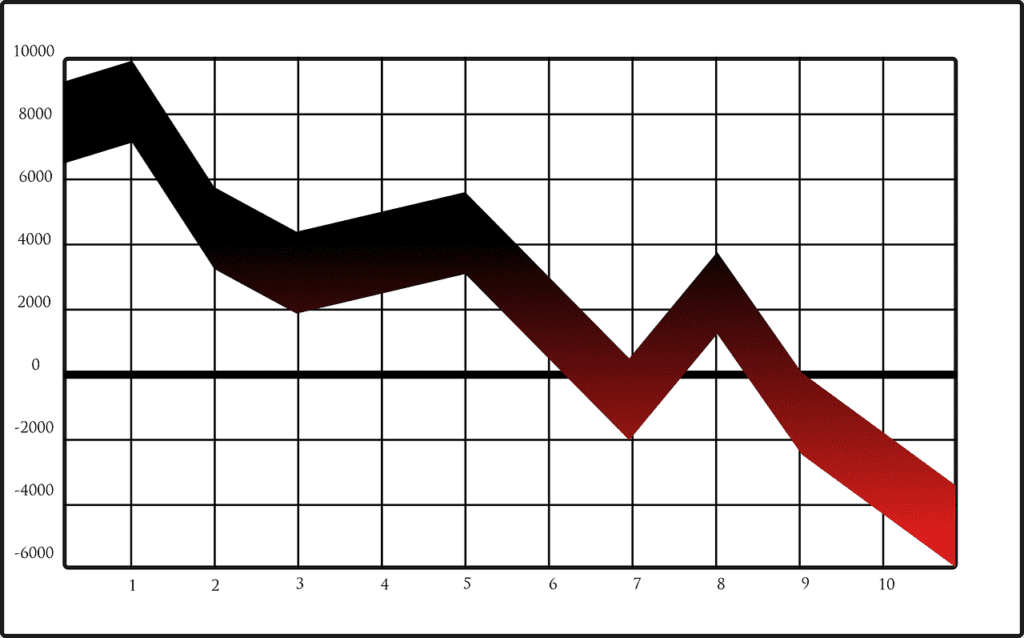

Recently, I have seen many articles stating that the stock market will drop by 5%-20% by the end of the year. Despite these many predictions by pundits, analysts, and economists, no one knows the market’s future direction—even if they guessed right previously. I can say this with certainty because the world doesn’t have a trillionaire.The truth is that the market has cycles, and, historically, the market has a significant correction every 6-7 years. So, hypothetically, if a stock market doesn’t have a substantial correction for six years, you can predict that there is a correction right around the corner and be right reasonably often.Periodic market downturns are inevitable. People try to time markets by selling all their stocks when they are high and buying back in when they are low. There are several key problems with this strategy:Studies have shown that investors who try to time the market end up selling low and buying high—the exact opposite of the behaviors that will make you money. A significant reason for these investing errors is a concept called behavioral finance—it is the study of how psychology affects our ability to make rational investing decisions. For instance, investors often hold losing positions rather than feel the pain associated with taking a loss.Another downside to this strategy is that you will pay capital gains taxes when you sell your stocks in anticipation of market losses. Suppose that you purchased a stock for $100, and it increased in value to $250 over three years. Then, you sell all of your stock in anticipation of a market correction. You may owe $30 of your $150 in gains in taxes. That might not sound like a lot, but it means that you won’t be better off using this strategy unless you can buy back that stock for less than $220.Lastly, history has shown that market corrections end on a single day of substantial gains. Most investors who time the market miss that single-day turnaround and end up missing most of the benefit of their strategy.Here’s one final thing to ponder—I’ve never heard of a self-made billionaire who said, “I made it all from day trading!” Wise investors know that markets have cycles and need to keep their emotions in check when the roller coaster is in full swing.

Where is the Market Heading?

Finance Investing Retirement Stocks & The Markets

Signup For Our Newsletter

Signup for our newsletter to stay up to date with the newest financial trends

See How We Can Help You

With a combination of planning, consulting, and investing services, the Sterling team gives you all the resources you need to Plan Your Financial Future.

Get In Touch